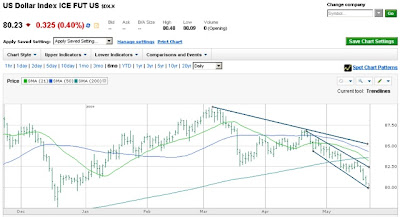

Treasury prices continue to rise in wake of this week's Treasury buying binge at the Fed. I believe they bought around $14.2 billion in bond's this week, yet interest rates continue to rise. This is the market calling out Treasury Secretary Geithner, who earlier this morning said his job was to sustain a strong dollar. If he is supportive of a strong dollar he will let interest rates rise and have no choice but to stop spending so much money. The U.S. cannot afford to continue to keep buying if rates keep rising. The market wants them to STOP buying because it's killing the dollar.

The dollar has dropped 10% since the market rally around March 9th. Dollar devaluation leads to anything priced in dollars to rise. The market has risen, basic materials has risen, commodities have risen, oil is above $60 and gold is above $950. The dollar droppage has led to a rise in the price of our necessities. That'll will correlate into the prices of companies that deal with those necessities to raise. As if said before, the worst thing that can happen to the U.S., economically, is for the dollar to lose its value.

Today, the market slipped 1.68%, which was led to one of the best indicators i've found, the Dow Transportations. It has been a lead indicator in recent market drops. It fell almost 4% and was approaching a very critical trendline around 2950. If it is to break through that trendline, we could very well see the market take a bit of a nosedive. With the market unsuccessfully able to break through its 200 moving average twice, I think is a tell. Bank of America, which has been a great tell the past couple of weeks, was off 0.7% and has been acting weird since its stock offering on Tuesday. Basic materials, which have been on a tear, saw a big pullback as well. It's an odd weekend because many investors are away due to Memorial Day and volume has been a bit low.

Home builders were down about 2%. There still will be no recovery in housing for some time to come. Low mortgage rates don't sell houses, low prices do. Tuesday, the Housing starts figure was 12% below consensus. The market reacted negatively to it off the bat, but digested the news and realized it was actually a good sign. Housing starts should fall, we're already sitting on a gluttony of inventory. There is no need for further building. We are still a long way from the bottom of housing because jobs continue to be shed, prices of our necessities are rising, and most people these days don't have enough actual savings to put a down payment on a home.

Anyways, if you really believe that housing is close to a bottom....then explain this chart to me. Yea...scary.

I continue to believe we are near a pretty big move downward. There has been a number of indicators starting to flicker, sentiment that continues to grow negative and news which shows no signs of recovery. Be careful with your investments at this point. The dollar continues to slide which makes those losses even more of an impact. It's time to start looking to move some dollars into foreign currencies.

No comments:

Post a Comment