Thursday, May 28, 2009

Auction and Market Update

As a side note, senior tranches of CMBS (commercial mortgage backed securities) are now back to trading around 800 basis points above swaps due to ratings agencies stating that they will not retain their AAA rating and therefore will not be allowed to participate in the TALF program.

Homebuilders are getting slammed today. Gold is trading strong along with oil. Piggies (banks) are strong and high beta is leading the charge.

Heading into the final hour. Good luck.

Irony?

“A nation that is afraid to let its people judge the truth and falsehood in an open market is a nation that is afraid of its people.” - J.F.K.

A little food for thought.

Wednesday, May 27, 2009

Dangerous Waters

Tuesday, May 26, 2009

Consumer sentiment sends stocks up

Thursday, May 21, 2009

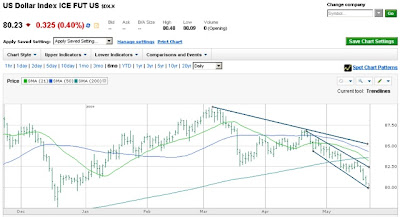

Down Goes the Dollar

Today, the market slipped 1.68%, which was led to one of the best indicators i've found, the Dow Transportations. It has been a lead indicator in recent market drops. It fell almost 4% and was approaching a very critical trendline around 2950. If it is to break through that trendline, we could very well see the market take a bit of a nosedive. With the market unsuccessfully able to break through its 200 moving average twice, I think is a tell. Bank of America, which has been a great tell the past couple of weeks, was off 0.7% and has been acting weird since its stock offering on Tuesday. Basic materials, which have been on a tear, saw a big pullback as well. It's an odd weekend because many investors are away due to Memorial Day and volume has been a bit low.

Home builders were down about 2%. There still will be no recovery in housing for some time to come. Low mortgage rates don't sell houses, low prices do. Tuesday, the Housing starts figure was 12% below consensus. The market reacted negatively to it off the bat, but digested the news and realized it was actually a good sign. Housing starts should fall, we're already sitting on a gluttony of inventory. There is no need for further building. We are still a long way from the bottom of housing because jobs continue to be shed, prices of our necessities are rising, and most people these days don't have enough actual savings to put a down payment on a home.

Anyways, if you really believe that housing is close to a bottom....then explain this chart to me. Yea...scary.

I continue to believe we are near a pretty big move downward. There has been a number of indicators starting to flicker, sentiment that continues to grow negative and news which shows no signs of recovery. Be careful with your investments at this point. The dollar continues to slide which makes those losses even more of an impact. It's time to start looking to move some dollars into foreign currencies.

Monday, May 18, 2009

Monday, May 11, 2009

Correction phase?

The Fed will most likely expand its Quantitative Easing practices within the next couple of weeks. Yields on the 10-yr have been steadily rising since April 15th. The yields on the 30-yr have been rising since the bad auction last week. Don't forget, the Treasury is still going to attempt to sell $2 trillion more in bonds this year. Think that'll happen?

The judge in the Chrysler bankruptcy decided to not allow the anonymity of the bondholders that are not accepting Chrysler's restructuring offer. They feared for their safety, while trying to get the best deal for their investors. The judge said no, so two of the "non-tarp" lenders, Oppenhiemer and Stairway Capital Management, gave up their rights as a bondholders and more or less conceded saying they will forfeit the money they are owed in order to not be a part of this bankruptcy. To fully present the entire picture to you though, the creditors did have to sign some type of special seal which would keep their names anonymous during the hearings, but as the judge said no. It's not like he did this to be a tough guy, he simply said no to the special seal they were applying for. It's always good to see both sides of the story even if you don't necessarily agree with one side. To me this sounds like things will get messy. Remember the outrage over the AIG bonuses, well that is only the tip of the ice berg.

Thursday, May 7, 2009

Crazy week coming to a close

Tuesday, May 5, 2009

How did we get here?

This created bubbles within the capital markets and would later trickle down into the economy. Lots of new wealth was created in this short time. Most of it was caused by the rise of financial assets, which is not backed by anything tangible. Many people did not know how to handle this new found wealth. They went out and bought multiple houses, cars, luxury items (jewelry, clothing, vacations, airplanes, boats, you get the picture), which only exacerbated our problem of having capital misallocated. The longer capital is wrongfully invested, the larger a bubble will grow.

Think about giving a kid money while his/her parents are away. If the kid has $10 a day to spend on food, the money will mostly be used on pizza or candy. Now since the pizza and candy companies are making more money, they will produce more. Since the kid doesn't want fruit and vegetables, the apple and the carrot companies have less profits and therefore produce less. This isn't healthy for the industry as a whole because they all count on one another for healthy and sustainable growth. So as you can see, allowing someone with new found wealth to spend freely, will create imbalances which lead to bigger problems.

Once the dot.com bubble popped in 2000, markets were sent crashing down and recession was imminent. Recession is actually a good thing, contrary to popular opinion. It means that businesses were growing too fast for their own good and need time for a healthy pause to almost re-balance themselves. Recessions allow the poorly allocated capital to be reallocated to productive businesses which foster economic growth. Think energy, infrastructure, utilities, semi-conductors, things that will improve our daily life and allow both people and businesses to become more efficient. A tool that can used to make investors allocate capital more productively is interest rates. An interest rate is simply the cost of money. If you have a $100 loan with a 1% interest rate, you owe the lender $1 for each interest payment. If you have a $100 loan with a 10% interest rate, you now owe the lender $10 each interest payment and must therefore invest your money wisely in order to come up with enough to cover your interest payments.

In 2000 Allan Greenspan clearly did not want the U.S. to enter recession. As I said before recession is good because the private market will reallocate capital to more productive businesses. In order to avoid recession, Greenspan lowered interest rates, with the benefit of hindsight, was one of the worst possible moves he could have made.

Here is a chart of the Federal Funds Rate from 2000-2006.

As you can see rates were cut in half in the following year and half and eventually stayed below 2% from late 2001 all the way until early 2005. Now some of you may ask why is lowering interest rates such a bad idea. Well when we had a giant bubble build up in the stock market which led to the misallocation of trillions of dollars, why would we further exacerbate the problem of misallocation by making money cheaper to borrow? Makes no sense to me.

This created the world's largest credit bubble. The credit bubble acted like a cancer, spawning new bubbles in other sectors. The most dangerous bubble, which I will write about next, was real estate. Rather than investing in stocks, which may cost anywhere from $1/share to $500/share, overnight millionaire investors could now speculate in the biggest market in the U.S. Why flip stocks when you can flip houses? Why flip houses when you can flip mansions? Tomorrow I'll go into the boom and bust of the real estate market in the U.S. and show you how that factored into this financial mess.

Sunday, May 3, 2009

Random rambling

Friday, May 1, 2009

Period of uncertainty

I speculated that the Fed was going to announce further quantitative easing on Wednesday and was incorrect. The dollar clawed back after their non-announcement, interest rates rose on the 10-yr, and the short 7-10 yr Treasury ETF saw gains. Caught off guard by the non-announcement, I thought about it for a while and it made more sense. Everyone thought the Fed was going to buy more debt. They acted like contrarians and didn't. Last time the Fed announced they were going to buy Treasuries, rates still rose. The Fed doesn't want monetize the debt if rates are going to keep rising in the face of them buying. The announcement said, "The committee will continue to evaluate the timing and overall purchases of securities in light of the evolving economic outlook and conditions of the market." There is no doubt they will have to buy more because the housing recovery plans assume mortgage rates will be low and with the bond traders pushing rates up, this would create a problem. This was a smart move by the Fed because they are going to keep traders on their toes and will leave any investors shorting the bonds at risk. At the same time this creates more uncertainty surrounding the market because at anytime the Fed can announce more debt purchases. Overall this is negative for the dollar, which I believe, is the main barometer of economic health. The weaker our dollar gets, the more purchasing power we lose, the more our standard of living goes down. The current administration doesn't seem to care much about the dollar, but that's an entirely different debate.

Yesterday, Chrysler announced they are going to claim bankruptcy. If I was a creditor of the company, I would have balked at Chrysler's offer. They would basically get pennies on dollar for the money they are owed. I would take my chances in bankruptcy, hoping to get more than what Chrysler was offering. This is going to be an interesting event to follow. Going into bankruptcy is obviously not a good thing. The government wants this to be a quick 30-90 day process. This is going to be a long drawn out process unless someone from the government strong arms some "friends" in bankruptcy court. This could be an example for what's to come with other companies that could potentially go into bankruptcy. Investor psychology will be effected by this and will be important to track. Real tough trying to discount the bankrupcty case into stock prices.

Goldman had a $2 billion dollar debt offering and raised $750 million in a stock offering. If the company that runs the world is building it's capital base, what does that tell you? The "too big to fail" banks are in need of capital says the make believe stress test regulators. Did we really need to test these banks to know they are under tremendous stress? C'mon that's ridiculous. Look at what's been going on in these companies since October 2007 and you'll see if they are stressed. This test is just another way for the government to buy time before the day of reckoning. Banks are now arguing that the test doesn't show conclusive evidence they need to raise capital. The "too big to fail" banks are insolvent and do not need capital. They need to fail. Stop all this propping up and creation of zombie banks which will ultimately be ran by the government. My take is that these tests will be used as a backdoor way to nationalize the big banks. Sneaky, but a lot better than just announcing outright nationalization of the banks....well atleast from a PR prospective. These damn Keynesians are ruining our once robust economy.

I feel like this market is running out of gas. April was the first month of the new quarter and investors will like the way it started. The sell in May and go away mantra is starting to surface. Investors have been shrugging off horrendous news for quite some time now. The SP is hitting resistance around 900, which will be tough to break through. While this 23% run up since the May 6 low of 666, could have more legs, I think it's an opportune time to look to build some short positions. Many people are claiming this new bull market will continue but remember the popular opinion is rarely the profitable one.

That's it for now. Be back after the market closes. Have a good day.