It's a beautiful day as summer draws to a close and a fresh new football season is upon us. This is my favorite time of the year, the transition from late summer into fall; weather is perfect, football is back, playoff baseball is starting, and golf season hits its prime. Now if only the markets could be as peaceful as the changing of the seasons...

Couple thoughts/questions

-Brett Farve has tarnished his greatness. The man is a horrible teammate and is the antithesis of a pre-madonna. Would you like someone on your team who skips the entire pre-season, doesn't know the playbook, and has little to no commodore with his teammates? I sure as hell wouldn't. Farve thinks the world revolves around him, which is never a good mindset for someone who goes to war alongside ten others each Sunday.

-Are people beginning to realize that China is the dog that wags the U.S. tail? The Shanghai index is down 21% in the last fifteen calendar days. Why? Like I said before, lending has tightened and taken a good amount of liquidity out of the market. From a structural standpoint, it's better off they tightened their policies, but what kind of ripple effect will it have on global capital markets?...especially as a leading indicator for what's to come in U.S./European markets.

-The Financial Times reports that global bond issuance surpassed the $1 trillion mark for the first time in a single year....and it's only August.

-Oddly enough, a credit analyst at Morgan Stanley issued an alert to investors on corporate bonds after the explosive rally we've seen. The article says...

---September options contracts signal volatility, but corporate bond spreads continue to tighten.

---Credit rallies typically anticipate stocks by about three months, but we're past that stage and the two should be converging now. That means stocks must either rise sharply or spreads must widen to reflect risks.

---Spreads have recovered in just eight months, which it normally takes three years. The credit market is saying the "Great Recession of 2008-2009" was much ado to nothing.

-It's both odd and fitting that those are two of the headlines we see today. Could it be signalling a top for credit markets with speculation of danger ahead?

-Are we churning? Are we basing? Are we working off overbought conditions as a function of time or price?

-What will be the next catalyst to the send market up or down?

-What's up with the huge draw on crude inventories? Are countries, yes countries, not companies, trying to hold it around $70/barrel? If the price falls too much, won't that have a big impact on oil exporting nations...which also seem to have the most political instability? Which will have an effect on social moods....which will have an effect on global capital markets...

-What draft position will I get for next Sunday's fantasy football draft (as the reigning champ)?

-Have the Yankee's peaked too early, leaving room for the Sox to make a run?

-Enough rambling for now. Good luck today!

Wednesday, August 19, 2009

Thursday, August 13, 2009

Complex Outlook

We find ourselves in the midst of major crosscurrents of prices, trends, expectations and psychological effects. On one hand, we have a market which has rallied about 50% since its March lows. Credit spreads have tightened, LIBOR has stabilized, banks have been recapitalized, housing shows signs of bottoming out, cars are flying off the lots, and earnings season was a home run. Sounds like a new bull market to me. But as we look a little deeper into things, every area that has seen improvement has to thank the gov't for propping it up. Credit spreads (gov't guaranteeing debt), banks (TARP, TALF, PPIP, etc), housing (tax credits & mortgage modifications), cars (cash for clunkers), earnings (pent up demand & heavy discounting). Employment is still crumbling. The seasonal adjustments show signs of life, but many people are no longer being counted as a statistic because their unemployment benefits have run dry. This exacerbates delinquencies (credit cards), defaults (all consumer loans), and foreclosures (housing). That doesn't point towards any type of sustained recovery when an economy is 70% leveraged to the consumer.

Next, we have the markets biggest conundrum, China. The newly anointed leader of global growth is having its own problems. Can they be the anchor for the global economy? Seems as if our friends in the east are having a tough time shouldering the load. With commodity prices more or less following the lead of Chinese demand, any decrease in demand will have adverse effect on prices. Thanks to the gov't stimulus, Chinese banks have been lending out money as if were 2003 in the U.S.A. While this money was originally meant to be for infrastructure projects (real estate development, building repairs, roads, bridges, etc), a good amount of the money has leaked into the equity and housing markets, therefore sending asset prices up. Sound familiar? Just in the past two weeks we've seen two near 5% corrections (drops) in the Shanghai index...stability? We're also seeing dissension within the Chinese ranks. The vice finance minister said China will create an "internal mechanism" to stabilize the stock market while a deputy governor of the central bank, on the same day, said they won't consider asset prices when adjusting policies. As Ron Burgandy would say, "Agree to disagree". I guess that go in Hollywood, but in global central banking, it simply doesn't cut it. Add to that, the president of China Construction Bank (2nd largest in China) said they plan on cutting new lending by 70%. Maybe they're realizing it's not a great idea to simply lend out money to anyone who asks for it. Also, China's GDP growth has been due to accounting rules, which vary greatly from the ones we use in the U.S. Too much to go into at this time, but trust me on this one.

Next on the list is Europe. As I noted before, the European banking system is on the verge of demise. You'd think that the Euro would weaken against the USD, but this are no time for conventional wisdom. The EUR/USD has been ripping as of late. Eastern European banks are insolvent. Germany seems to be the only Western European nation that has its head on straight. Thank Ms. Merkel for that. The picture is pretty bleak in Europe as well, but they have seemed to fly under the radar as of late. The UK announced further plans to use quantitative easing and the Pound got beat up pretty good thanks to that. As I've said before, no economy can be healthy if the banking system is sick. The European banking system/model is sick...very sick.

This obviously comes off as a bearish outlook right? Well, those are my medium to long-term ideas. As for the current, I expect this rally to extend. We will most likely have a basing at the current levels while market participants digest the great earnings season and the better than expected news inflow on the economic front. There are two factors I'd like to bring into play. First is the large amount of cash still on the sidelines sitting in treasuries and money markets. If this money comes back into the market it could fuel a liquidity driven rally...simple supply/demand. Second is a psychological factor. With many portfolio managers being underweight equities, the fear of under-performance is setting in. Their "risk" lies in a further rise in the market. This completely changes their mindset. They are waiting for a pull back so they can jump back into a more neutral weight position and gain some ground which they lost from being underweight during the recent rally. They are buying the dips which means that any pull back could be minor at best. Between the cash on the sidelines and the portfolio managers waiting to get back into the market on any meaningful pull back, the likelihood of a short term run up to the 1100-1200 range is inscreasing.

I believe a lot of the markets confidence has come from China. I believe this past 5 month rally to be completely based on psychological and technical factors, nothing fundamental. The fundamentals are deteriorating. With China more or less propping up commodity prices, the market has used the basic material sector as a foundation for the rally. The perception that banks are "out of the woods" is also having an effect of investors confidence. This market is hinged on stabilization of commodity prices. China will stay strong until October 1, its 60 year anniversary of its revolution and founding of the People's Republic of China (communism). That is about 6 weeks away.

China has also been in recent talks with U.S. officials. Hillary has said that China is "comfortable" with its lending to the U.S. I'm glad glad we're taking cues from a communist gov't. If they weren't so comfortable, the Chinese could dump the USD reserves and kill the dollar. They'd be screwed because the money we owe them would then be worthless and their biggest export partner would be dead. They don't want this to happen, so they must have made some type of deal to keep funding the U.S. deficit in return for the U.S. to either raise taxes or cut spending.

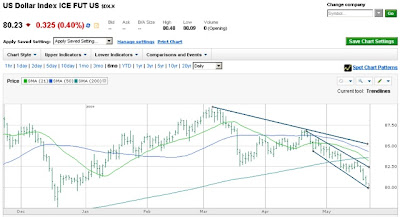

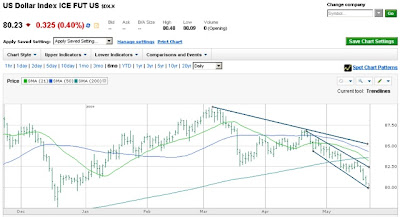

There is still so much debt in the "system" still, it trumps the amount of capital available in the entire globe. This debt is going to be reduced or deflated. Debt reduction will strengthen the USD. This is going to go on longer than most people think. As I've said before, when the dollar goes up, equities go down. Actually, anything priced in dollars will go down.

The dollar strength will coincide with Chinese weakness (after October 1) pressuring commodities. When commodities drop this will trigger the rest of the market will follow. This is going then put more attention on the balance sheets of the banks and we'll have a deflationary spiral begin. I'm not saying this is going to get out of control, although it could, but we'll see a more than expected drop in asset prices. With investor psychology so fragile at this point, the change of attitudes is going to have a lasting effect on investment decisions (risk averse in the realm of losses).

Conclusion: Short-term bullish into September - October. Going into that time frame I'll be looking into going long the dollar, long select consumer non-cyclicals, short commodities, short financials, short retail, short China, short European banks.

Just one man's humble outlooks. Good luck today!

Next, we have the markets biggest conundrum, China. The newly anointed leader of global growth is having its own problems. Can they be the anchor for the global economy? Seems as if our friends in the east are having a tough time shouldering the load. With commodity prices more or less following the lead of Chinese demand, any decrease in demand will have adverse effect on prices. Thanks to the gov't stimulus, Chinese banks have been lending out money as if were 2003 in the U.S.A. While this money was originally meant to be for infrastructure projects (real estate development, building repairs, roads, bridges, etc), a good amount of the money has leaked into the equity and housing markets, therefore sending asset prices up. Sound familiar? Just in the past two weeks we've seen two near 5% corrections (drops) in the Shanghai index...stability? We're also seeing dissension within the Chinese ranks. The vice finance minister said China will create an "internal mechanism" to stabilize the stock market while a deputy governor of the central bank, on the same day, said they won't consider asset prices when adjusting policies. As Ron Burgandy would say, "Agree to disagree". I guess that go in Hollywood, but in global central banking, it simply doesn't cut it. Add to that, the president of China Construction Bank (2nd largest in China) said they plan on cutting new lending by 70%. Maybe they're realizing it's not a great idea to simply lend out money to anyone who asks for it. Also, China's GDP growth has been due to accounting rules, which vary greatly from the ones we use in the U.S. Too much to go into at this time, but trust me on this one.

Next on the list is Europe. As I noted before, the European banking system is on the verge of demise. You'd think that the Euro would weaken against the USD, but this are no time for conventional wisdom. The EUR/USD has been ripping as of late. Eastern European banks are insolvent. Germany seems to be the only Western European nation that has its head on straight. Thank Ms. Merkel for that. The picture is pretty bleak in Europe as well, but they have seemed to fly under the radar as of late. The UK announced further plans to use quantitative easing and the Pound got beat up pretty good thanks to that. As I've said before, no economy can be healthy if the banking system is sick. The European banking system/model is sick...very sick.

This obviously comes off as a bearish outlook right? Well, those are my medium to long-term ideas. As for the current, I expect this rally to extend. We will most likely have a basing at the current levels while market participants digest the great earnings season and the better than expected news inflow on the economic front. There are two factors I'd like to bring into play. First is the large amount of cash still on the sidelines sitting in treasuries and money markets. If this money comes back into the market it could fuel a liquidity driven rally...simple supply/demand. Second is a psychological factor. With many portfolio managers being underweight equities, the fear of under-performance is setting in. Their "risk" lies in a further rise in the market. This completely changes their mindset. They are waiting for a pull back so they can jump back into a more neutral weight position and gain some ground which they lost from being underweight during the recent rally. They are buying the dips which means that any pull back could be minor at best. Between the cash on the sidelines and the portfolio managers waiting to get back into the market on any meaningful pull back, the likelihood of a short term run up to the 1100-1200 range is inscreasing.

I believe a lot of the markets confidence has come from China. I believe this past 5 month rally to be completely based on psychological and technical factors, nothing fundamental. The fundamentals are deteriorating. With China more or less propping up commodity prices, the market has used the basic material sector as a foundation for the rally. The perception that banks are "out of the woods" is also having an effect of investors confidence. This market is hinged on stabilization of commodity prices. China will stay strong until October 1, its 60 year anniversary of its revolution and founding of the People's Republic of China (communism). That is about 6 weeks away.

China has also been in recent talks with U.S. officials. Hillary has said that China is "comfortable" with its lending to the U.S. I'm glad glad we're taking cues from a communist gov't. If they weren't so comfortable, the Chinese could dump the USD reserves and kill the dollar. They'd be screwed because the money we owe them would then be worthless and their biggest export partner would be dead. They don't want this to happen, so they must have made some type of deal to keep funding the U.S. deficit in return for the U.S. to either raise taxes or cut spending.

There is still so much debt in the "system" still, it trumps the amount of capital available in the entire globe. This debt is going to be reduced or deflated. Debt reduction will strengthen the USD. This is going to go on longer than most people think. As I've said before, when the dollar goes up, equities go down. Actually, anything priced in dollars will go down.

The dollar strength will coincide with Chinese weakness (after October 1) pressuring commodities. When commodities drop this will trigger the rest of the market will follow. This is going then put more attention on the balance sheets of the banks and we'll have a deflationary spiral begin. I'm not saying this is going to get out of control, although it could, but we'll see a more than expected drop in asset prices. With investor psychology so fragile at this point, the change of attitudes is going to have a lasting effect on investment decisions (risk averse in the realm of losses).

Conclusion: Short-term bullish into September - October. Going into that time frame I'll be looking into going long the dollar, long select consumer non-cyclicals, short commodities, short financials, short retail, short China, short European banks.

Just one man's humble outlooks. Good luck today!

Wednesday, August 12, 2009

Heatlh Care Reform

John Mackey, CEO of Whole Foods, seems to be one of the few practical minds in today's corporate America. His comments are very Atlas Shrugged-esque. A breath of fresh air for once.

Many promoters of health-care reform believe that people have an intrinsic ethical right to health care—to equal access to doctors, medicines and hospitals. While all of us empathize with those who are sick, how can we say that all people have more of an intrinsic right to health care than they have to food or shelter?

Health care is a service that we all need, but just like food and shelter it is best provided through voluntary and mutually beneficial market exchanges. A careful reading of both the Declaration of Independence and the Constitution will not reveal any intrinsic right to health care, food or shelter. That's because there isn't any. This "right" has never existed in America.

Even in countries like Canada and the U.K., there is no intrinsic right to health care. Rather, citizens in these countries are told by government bureaucrats what health-care treatments they are eligible to receive and when they can receive them. All countries with socialized medicine ration health care by forcing their citizens to wait in lines to receive scarce treatments.

Although Canada has a population smaller than California, 830,000 Canadians are currently waiting to be admitted to a hospital or to get treatment, according to a report last month in Investor's Business Daily. In England, the waiting list is 1.8 million

Many promoters of health-care reform believe that people have an intrinsic ethical right to health care—to equal access to doctors, medicines and hospitals. While all of us empathize with those who are sick, how can we say that all people have more of an intrinsic right to health care than they have to food or shelter?

Health care is a service that we all need, but just like food and shelter it is best provided through voluntary and mutually beneficial market exchanges. A careful reading of both the Declaration of Independence and the Constitution will not reveal any intrinsic right to health care, food or shelter. That's because there isn't any. This "right" has never existed in America.

Even in countries like Canada and the U.K., there is no intrinsic right to health care. Rather, citizens in these countries are told by government bureaucrats what health-care treatments they are eligible to receive and when they can receive them. All countries with socialized medicine ration health care by forcing their citizens to wait in lines to receive scarce treatments.

Although Canada has a population smaller than California, 830,000 Canadians are currently waiting to be admitted to a hospital or to get treatment, according to a report last month in Investor's Business Daily. In England, the waiting list is 1.8 million

Wednesday, August 5, 2009

The New Wall St Reality

Courtesy of Zero Hedge...

GM chapter 11 = PRICED IN

125K+ jobs lost from GM chapter 11 = PRICED IN

unemployment @ 9% = BETTER THAN EXPECTED

unemployment @ 10% = DOW SOAR

Sunemployment @ 11% = GREEN SHOOT RALLY

unemployment @ 12% = ALREADY FACTORED IN

unemployment = 35% = DOW DROPS 100 POINTS

housing price =1% = RECESSION ENDING

housing collapses = GREEN SHOOT

Housing falls 20% = STABILIZATION

Government spends 1 trillion of OUR dollars = STIMULUS

North Korea fires nuke = RALLY

Israel bombs Iran = 30 MINUTE END OF DAY RALLY

world explodes = ASIA RALLIES

PMI crashes = HUGE RALLY

No jobs are created = RECESSION ALMOST OVER

U.S. debt overwhelming = TOO BUSY RALLYING TO CARE

Consumer stops spending = RETAIL RALLY

Banks are insolvent = SIGNS OF STABILIZATION

American auto industry BK = GOOD THING

Banks pass scam stress tests = HUUUUUUUUGE RALLY

Banks "only need 75 billion = OUT OF THE WOODS

Banks pass a real stress test = NEVER WOULD HAPPEN

Banks pay back tarp = LATE DAY SURGE

Banks can't pay back TARP = EARLY MORNING SURGE

12% mortgage delinquency = GOOD FOR STOCKS

Hundreds of thousands of mortgages underwater = HOUSING BOTTOMED

Dollar rises = RALLY

Dollar crashes = RALLY

Inflation = BULL MARKET

Deflation = BULL MARKET CONTINUES

REFLATION = MASSIVE SHORT COVERING RALLY

Gold rises = STOCKS RALLY

Gold falls STOCKS RALLY

BIGBanks' fake earnings = SIGNS OF STABILIZATION

CRE stabilizing= 1000 POINT RALLY

CRE CRASHING = STOCKS SHAKE IT OFF TO RALLY

CONSUMER INSOVENT = CONSUMER IS SPENDING

OIL @ 50 = BULL RALLY

OIL @ 60 = GREEN SHOOT

OIL @ 100 = IMPORTANT RECOVERY SIGN

OIL @ 20 = TAX BREAK

And the one we should all interpret correctly:NO ONE IS BUYING STOCKS = BILLIONS ON THE SIDELINES

GM chapter 11 = PRICED IN

125K+ jobs lost from GM chapter 11 = PRICED IN

unemployment @ 9% = BETTER THAN EXPECTED

unemployment @ 10% = DOW SOAR

Sunemployment @ 11% = GREEN SHOOT RALLY

unemployment @ 12% = ALREADY FACTORED IN

unemployment = 35% = DOW DROPS 100 POINTS

housing price =1% = RECESSION ENDING

housing collapses = GREEN SHOOT

Housing falls 20% = STABILIZATION

Government spends 1 trillion of OUR dollars = STIMULUS

North Korea fires nuke = RALLY

Israel bombs Iran = 30 MINUTE END OF DAY RALLY

world explodes = ASIA RALLIES

PMI crashes = HUGE RALLY

No jobs are created = RECESSION ALMOST OVER

U.S. debt overwhelming = TOO BUSY RALLYING TO CARE

Consumer stops spending = RETAIL RALLY

Banks are insolvent = SIGNS OF STABILIZATION

American auto industry BK = GOOD THING

Banks pass scam stress tests = HUUUUUUUUGE RALLY

Banks "only need 75 billion = OUT OF THE WOODS

Banks pass a real stress test = NEVER WOULD HAPPEN

Banks pay back tarp = LATE DAY SURGE

Banks can't pay back TARP = EARLY MORNING SURGE

12% mortgage delinquency = GOOD FOR STOCKS

Hundreds of thousands of mortgages underwater = HOUSING BOTTOMED

Dollar rises = RALLY

Dollar crashes = RALLY

Inflation = BULL MARKET

Deflation = BULL MARKET CONTINUES

REFLATION = MASSIVE SHORT COVERING RALLY

Gold rises = STOCKS RALLY

Gold falls STOCKS RALLY

BIGBanks' fake earnings = SIGNS OF STABILIZATION

CRE stabilizing= 1000 POINT RALLY

CRE CRASHING = STOCKS SHAKE IT OFF TO RALLY

CONSUMER INSOVENT = CONSUMER IS SPENDING

OIL @ 50 = BULL RALLY

OIL @ 60 = GREEN SHOOT

OIL @ 100 = IMPORTANT RECOVERY SIGN

OIL @ 20 = TAX BREAK

And the one we should all interpret correctly:NO ONE IS BUYING STOCKS = BILLIONS ON THE SIDELINES

Monday, August 3, 2009

Walking a thin line

Social mood and the markets seem to walking a thin line right now. You think that's a coincidence? I don't. With the financial media declaring an end to the recession and the beginning of a new bull market, many on "main st" must be scratching their heads. I say give it the eyeball test...do things really seem better? No, but as we all know, the markets are leading indicators for the economy as a whole. Maybe things are getting better; GDP estimates came in better than expected, manufacturing indexes have shown improvement and the SP even made it's way back to 1,000. I believe we may be approaching a statistical recovery, which ties into a couple of my blogs last week about things "appearing" or "convincing" people things are better. Hopefully George Soros' theory of "reflexivity" will play out and perception will become reality and things will go back to normal. Although, it's true that hope is not a viable investment vehicle, so take it all with a grain of salt. The public doesn't know what to believe anymore. They're not convinced things are getting better with a real unemployment rate somewhere around 18%. The dichotomy between the two implies some volatile times ahead for capital markets in my humble opinion.

A couple of scattered thoughts for the first Monday in August of 2009:

-The equity market was strong today mainly in commodities and energy. Why you ask, well because the dollar index moved to a new low for 2009 pushing up anything priced in dollars.

-Being the first trading day of the month, August monthly inflows helped to put a bid under equities. Keep that in mind.

-HSBC caught some heat for not taking enough risk in the second quarter. They didn't acquire any U.S. investment banks unlike its rival Barclays who bought the bankrupt Lehman Brothers. -Read the market message: At bottoms underperforming managers are criticized for taking too much risk. At tops they're criticized for not taking enough.

-Mark-to-market being discussed again? FASB may want to bring it back. Banks say keep it away we want to value our "assets" at what we "think" they're worth, not what they're currently selling at. Makes sense...ehhhh

-Interesting timing for this to hit news stands considering where the tape stands.

-"Cash for clunkers" seems to be a wild success. I was watching yesterday's PGA event on t.v. and it seemed like every commercial was a cash for clunkers ad. Keep it mind it was the Buick Open, but the ad was a bit redundant.

-Initially we bought (not directly) $1 billion worth of cars, that for the most part have little economic value.

-Friday we decided to go long (buy) another $2 billion because the first attempt was so successful.

-This is a one time purchase and doesn't account for long-term savings. (excluding gas)

-To look at it through both lenses: bull - we're (taxpayers) helping the pent up demand in autos. bear - future sales are being diminished because of the incentive to buy now.

-Staying with the automotive theme, Ford's sales were up 2.3% last month. Thanks taxpayers!

-Still feeling the automotive flow...doing the bull dance. Palladium, which is a main component in catalytic converters, has seen a steady rise in price. Thanks to Ford? I doubt it. Tata Motors of India is releasing a car for first time buyers which is priced at $2,053. India's 18 and under population is larger than the entire U.S. population. Do you smell demand?

-Green Mountain Coffee decided to float another 4 million shares to pay back debt. They mustn't have gotten the note from banks that it's a good idea to sell equity to pay old debts. Something bad may be brewing and it's not the coffee so keep your eyes peeled.

-Insider selling is at a 4.16 to 1 ratio meaning that for every 1 share that is bought 4.16 are sold. The last time the ratio was this high...October of 2007 when U.S. equity markets reached their all time highs.

There you have it. A few randoms to hopefully provoke some thought. As a friend of mine always says, think positive because profitability begins within. Good luck tomorrow!

Thursday, July 30, 2009

Similarities

Just a quickie that caught my eye.

Financial Times headline today "European equities staged a broad-based rally on Thursday, hitting a fresh eight month high as as string of mostly well-received corporate earnings convinced investors the recent run should continue."

The term convinced and my blog last night about the word appear seem to be interchangable. Whether you're trying to convince investors or whether you're trying to make things appear to be healthy, you are actually trying to fool them. My only question is, how much longer can the situation appear to be getting better; how much longer can investors be convinced this rally has fundamental support? With the SP around the 1,000 level, it could extend to 1,100.

Financial Times headline today "European equities staged a broad-based rally on Thursday, hitting a fresh eight month high as as string of mostly well-received corporate earnings convinced investors the recent run should continue."

The term convinced and my blog last night about the word appear seem to be interchangable. Whether you're trying to convince investors or whether you're trying to make things appear to be healthy, you are actually trying to fool them. My only question is, how much longer can the situation appear to be getting better; how much longer can investors be convinced this rally has fundamental support? With the SP around the 1,000 level, it could extend to 1,100.

Wednesday, July 29, 2009

Exit strategy appearing?

It's late, but I wanted to throw up a couple thoughts on some comments coming from Federal Reserve Members today.

First comment was from William Dudley of the New York Fed. Mr. Dudley said, "new Fed asset purchase programs will grow its balance sheet to $2.5 trillion, which is above the peak in December."

Next we have James Bullard from the St. Louis Fed saying, "if you permanently double the money supply, you will eventually double prices. It takes time for price levels to rise."

"The Fed can never and will never shrink its balance sheet. The Fed filled a giant capital hole in the banking system with newly created (printed) money; it cannot "take back" money any more than a surgeon can give a patient a new heart then "take it back" once the patient appears to be better."

The first thing that comes to my mind is, well, so much for the Fed's exit strategy and the good ol' greenback. The bigger the Fed balance sheet grows, the longer this crisis will last. All they are trying to do is buy time for the "toxic assets" to get back to fair value. How are they going to do this? Kill the U.S. dollar and inflate the hell out of the economy. The money supply has more than doubled and as Bullard said, the Fed can't take the money back.

Bullard should have used a better choice of words. Something that stuck out to me was his comment that "the surgeon can't "take back" the heart once the patient appears to be better." Appearing to be better and actually being better are two completely different things. Appearing to be better makes me think of some type of mirage. Sort of like the mirage of wealth people around the world thought they had before asset prices started declining the past two years; or perhaps the appearance that the U.S. economy is stabilizing.

Our authorities want to make things appear to be getting better. From an operations stand point, I applaud U.S. companies for having such strong control over operations management, which is why most companies beat 2Q estimates. This is a bullish sign and a testament to those companies. The quicker companies can get their finances stabilized, the quicker the economy can reach a bottom. Unfortunately, sales in almost all sectors deteriorated sharply....not bullish.

One way that companies appeared to look strong was with the relaxation of mark-to-market rules. Rather than pricing assets at current market values, authorities think they should be priced at some fictional/historical based value. Example: I own a house that could sell for $250,000 at current market prices. I really like this house and just a few years ago it was worth over $400,000, so I think that I'll list its value as $385,000. But wait...if the house can sell for only $250,000 right now, how can I value it at $385,000? Isn't the price of any asset the amount it could be sold for in the market? That's what I thought, but apparently our authorities don't agree.

Mark-to-market mostly helps banks. If the banks balance sheets appear to be healthy, then we're on the road to recovery. What if they banks appear to be healthy, thanks to the accounting rule changes, but deep down are masking a disease? What if the banks just used the last bullet in their gun to beat 2Q estimates. Underwriting equity and debt offerings along with decreased competition (remember Lehman, Bear Stearns, Merrill Lynch?) will provide banks with nice cash flows. Now that the underwriting is going to slow down, where are the cash flows going to come from? Add to the fact gov't wants to regulate the amount of risk that the "big" banks can take.

These appearance games will continue. I think the gov't is buying the perception is reality idea. As long as things appear to be getting better, they must be getting better...right? After all, this is the age of self evidence.

Anyway, I like this quote and I find it fitting to end this blog. Good luck tomorrow.

"People do not wish to appear foolish; to avoid the appearance of foolishness, they are willing to remain actual fools."

Monday, July 27, 2009

Monday Metrics

It's been a while since I last posted. Honestly, it's summer time and while I study the markets all day, it's been a bit of a struggle to focus on writing at night. Either way, I'm back and looking to start fresh with some updated thoughts.

There is an endless number of subjects I could write about, but tonight I'd like to focus on how I'm trying to read the market. I'll start with a trading axiom, which I've grown to find very true: You can pick the direction or the timing of the market, but you'll rarely nail both.

There's four main metrics which I analyze: structural (macroeconomics, currencies, politics), psychological (investor psychology, social mood), technical and fundamental analysis. This is more from a trading point of view. If it were long-term investing the analysis would be a bit different.

1. I'm putting the least amount of emphasis on fundamental analysis. With the consumer deleveraging, rules changes (FASB 157, naked short selling), government interference (Obamacare - Healthcare nationalization, further stimulus, or any acronym for banks to swindle money from U.S. taxpayers), and it's very hard to forecast what future earnings may be and what type of growth companies will produce. It's simply too hard to attach a multiple to a stock and be confident that you'll get it correct. There will be some analysts who are spot on, and may even earn a name for themselves for a quarter or two, but that's simply due to the law of probabilities. When looking at different asset classes (mainly distressed debt, real estate) fundamental analysis plays a much bigger role.

2. Next is the structural metric. This is more of a big macro themed metric, which should always be in an investors mind, but may not be something to necessarily trade on. European banks, predominantly Eastern Europe, are on the brink of failure. Technically they are insolvent due to the fact they are so overleveraged, that many of the banks have assets which range from 4-7x greater than those countries GDP. Think about it. The banks have "assets" which are 4-7x the amount of money the entire country produces in a year. So a bailout is literally not possible...at least not economically possible.

Saying politics are playing a huge role in the markets is an understatement. Many of the rhetoric coming from Washington is a catalyst for a market move each day. With the seeming socialization of many huge sectors of the U.S. economy, politics will continue to play a larger role in determining how this market will function.

Last part of the structural metric is the most important. That is currencies. This is one market which is extremely hard, if at all possible, to manipulate. With the U.S. dollar being under constant fire and our Federal Reserve taking a weak dollar (bailouts, quantitative easing, debt issuance) stance, you have to question how long foreign investors will want to hang out to assets denominated in USD. Also, the dollar is the worlds reserve currency. We've already seen China and Brazil work a deal so that their trades will be settled in local currencies rather than dollars. This is the slow, but seems to be steady, transition away from the USD. This will have MAJOR implications over the global economy. This is a wild card that must be kept on everyones radar.

-The weakness of the dollar since the March lows has been one of the driving factors behind the market rally. This has also contributed to the doubling of oil in that time frame and the rally in commodities as well.

3. Technical analysis is better used in context rather than a catalyst. Much of technical analysis goes in hand with my last and most important metric at this time, which is psychology. Picking up on trends, resistance, and support levels, has proven to be a solid strategy to use during such tumultuous times. The only problem is that many of today's investors are using the same strategy. Like anything else in the the markets, once a trade becomes too popular and the herd starts moving in, that should be your cue to get out.

4. Last and what I currently believe to be most important is psychology. The psyche of investors right now is fragile to say the least. With markets still down around 40% from the 2007 highs and up 47% from the March low of 666, you can understand why. The government has provided drugs to act as symptoms for our disease, but I believe they are only masking the disease or kicking the can down the road. Thanks to government intervention, no one knows what's next to come from Washington. This has created a world of uncertainty and that's the one thing investors fear most.

We've had a euphoric rally in the past five months. Investors were sick of the gloom and doom, 666 seems to serve a psychological turning point (mark of the beast), second derivative data showed signs of deceleration of the downfall, and honestly, the market was just due for a bounce. Many of the biggest market bounces come in the context of a secular bear market, which is what I believe we are still in. A great earnings season (thanks to great operations management, not revenue growth or sales) has acted a major catalyst to send this market close the 1,000 level, but 980 is a huge resistance level.

I believe we are in the midst of a temporal transition which is transition from peak to trough (temperament) and emotions run highest at this point. There are not many economic data points that should send the market higher. A move to 1,100 wouldn't surprise me, but I look to get short in certain names and sectors as this rally moves on.

Without going into too much detail, I hope that provides a decent summary into how I am trying to read the markets at this time. Everyone has their own approach and I'm not trying to influence anyone one way or another, just trying to provoke thought. Hope all is well and good luck tomorrow.

Thursday, July 9, 2009

Tidbits

Just wanted throw a few thoughts out there before I head to Fenway for the game. One of my best friends is back from California and a group of us are heading to the game. Should be a good game with Brad Penny hurling for the Sox.

-The dollar is getting smacked around today and is pushing equities higher, but oil is still weak after briefly breaching the $60 level. The stock market is being driven by macro factors such as commodities, currencies, and government debt auctions. Remember last summer when oil was trading in the $130+ area and pundits said it is equity positive when oil drops? Now that the markets are more macro driven, the dive from $74 to $60 in oil has coincided with the SP hitting a two month low. Coincidence? I doubt it.

-California banks are going to stop accepting the IOU's on July 10. What are the recipients of the IOU's to do with there notes if they can't put them into a bank? Sell them for less than face value to outside vendors possibly, but they'd be getting shafted. Do you think the Fed and Treasury are going to allow the banks to do this? If yes, then the California economy, which is the main component of the U.S. economy, will continue to spiral out of control; If no, then the legislators in California know that the Fed is forcing banks to accept the IOU's and therefore they know they can continue to gear the budget towards what they want rather than what is needed. That essentially puts the great Californian bailout onto the Fed's shoulders.

-"Cash on the sidelines" debate/example. Bob has $150,000 in stocks, a $500,000 house and $25,000 in cash. Bob has $300,000 mortgage and $20,000 in credit card bills. His net worth is $355,000. The stock and housing market drops 50% and Bob has to liquidate his stocks because he took on too much risk. Bob now has $100,000 (cash and stock sale proceeds) and a house worth $250,000. He still has $320,000 of debt. Now his net worth is $30,000. Do you think that money is coming back into the market anytime soon? Sounds deflationary to me.

-Goldman Sachs had a password stolen to a system that automatically traded stocks and commodities. A press release from Goldman today said that password could be used to manipulate the markets. Ummm, does that mean that Goldman could manipulate the markets themselves then? We all know this is what they do anyways so I'm just throwing it out there.

-Read a great article in the FT yesterday from Mohammed El-Erian, one of the top dogs at Pimco and widely known as a brilliant financial mind. It was about the second stimulus plan and there was two important tidbits which I'd like to share. First, is this: he says, "What is economically desirable is increasingly becoming politically infeasible; what is politically desirable may well turn out to be economically undesirable." Secondly, he says, "The global crisis is morphing again. Having already contaminated (in a sequential and cumulative manner) housing, finance, and the consumer, it is now threatening the potency and credibility of the economic policy making apparatus. As far as I can see, there are no first best policy responses that are readily available and easy to implement. Instead, the economy will continue to struggle, navigating both the adverse implications of last year's financial crisis and the unintended consequences of the experimental policy responses. Given the inevitable social-political dimensions, this story will play out well beyond the realm of the economy, policy making and markets." That's some pretty heavy stuff. As I've said from the beginning, as the social moods move into more negative territory, the recession, or what I believe will turn out to be more of a depression, will only deepen. Let's hope policy makers can pull their heads out of the sand soon.

Heading out for the game. Take care.

Tuesday, July 7, 2009

Dr. David Bronner

Very lucid insights and predictions by a large retirement fund CEO.

Dr. David Bronner, CEO of the Alabama Retirement Systems, the 43rd largest investment fund in America, spoke at Rotary Club on July 3. He is one of the most highly respected fund controllers in the United States.

1) Next month (July) California hits the wall financially, that will send a ripple effect across the US economy, AND over the next two years one state after the other will fall to it's knees financially as the federal government stimulus package ends by 2011. It has helped various states at different levels comparative to their economic condition. He says the stimulus package is what's been keeping the states alive for now...except for California which was in such terrible shape the stimulus package wasn't enough to really help them. "They go first" he said. Alabama would hit the wall in February of 2011, late in the game as Alabama is in better shape than other states. Bronner says Alabama might dodge the bullet if the economy revives enough by then. But, he doesn't really think things will improve enough by then to avoid a crisis. "It will be the largest economic crisis in the history of the State of Alabama." Bronner says Alabama will experience such significant shortfalls by 2011 that taxes will have to be raised substantially to avoid collapse...probably on property. And that practically all states will face a similar fate.

2) Within 120 to 150 days from now the commercial real estate market nationally begins to collapse as stores, malls, and shopping strips, and industrial plant have enough closures (store and plant) and loss of rental revenue to make them unable to pay their mortgages. They will start going into foreclosure unable to pay their mortgages in a significant way at that time creating a second wave of economic disaster starting three to four months from now.

3) Unless oil stays above $70 a barrel Russian and Mexican economics will begin to unravel as countries ("socio-economic collapse) economies require that much from oil to have an adequate revenue stream to feed their people and economies. AND, the only other big revenue stream for Mexico is illegal drugs sold in the US...so their economy will intensify their focus on selling drugs in America as a result in order to survive if oil doesn't stay above $70...he said $90 would be better for them.

4) The US economy (according to Bronner) is today like a patient in the emergency room in the process of having a heart attack. He said people tend to think of it as being in the hospital for cancer or chronic disease. Without the huge Bush stimulus, and then the huge Obama stimulus, the economy would have already flat lined...(i.e. we'd be experiencing a Great Depression style economic collapse heading toward 25% unemployment or so as the tumble would have continued and intensified at an increasing rate, with the stock market hitting around 2,000) Bronner said the depth of the crisis was greater than ANYONE realized and agrees today, after learning the extent of the crisis, that the federal government simply had to start "shoveling" money at it to prevent a true and complete collapse of our economy. He said he, at first, was mad at this shoveling of money until he learned the truth about the amount of money necessary to prevent a total collapse which he believes would have happened.

5) Inflation will not arrive for 3 to 5 years as the economy is in a deflationary stage due to the economic plummet...and will not experience inflation until people start "buying things" again, and that's going to take while! He also believes 3 to 5 years is probably the term until true economic recovery establishes in the US and world economy.

6) China must start selling their products to people in their own country and paying their workers enough to buy them. This would increase their products prices, reducing their exports (and "besides they will lose interest in having more US dollars anyway") and enabling other countries (US) to compete with them.)

7) The greatest threat to the US economy is one of around 9 world events that could heap misery on top of misfortune at exactly the wrong time. A nuclear incident with N Korea, a plague, Israel attacking Iran (oil shock), or such could still throw the US economy into a Great Depression style situation. He said the greatest risk of this is anytime from now until the world economy gets somewhat back on it's feet...in 3 to 5 years.

Not all his thoughts may play out, but it's another voice to listen to. Although his ideas are quite pessimistic, they're more realistic than 90% of the garbage in today's media.

Dr. David Bronner, CEO of the Alabama Retirement Systems, the 43rd largest investment fund in America, spoke at Rotary Club on July 3. He is one of the most highly respected fund controllers in the United States.

1) Next month (July) California hits the wall financially, that will send a ripple effect across the US economy, AND over the next two years one state after the other will fall to it's knees financially as the federal government stimulus package ends by 2011. It has helped various states at different levels comparative to their economic condition. He says the stimulus package is what's been keeping the states alive for now...except for California which was in such terrible shape the stimulus package wasn't enough to really help them. "They go first" he said. Alabama would hit the wall in February of 2011, late in the game as Alabama is in better shape than other states. Bronner says Alabama might dodge the bullet if the economy revives enough by then. But, he doesn't really think things will improve enough by then to avoid a crisis. "It will be the largest economic crisis in the history of the State of Alabama." Bronner says Alabama will experience such significant shortfalls by 2011 that taxes will have to be raised substantially to avoid collapse...probably on property. And that practically all states will face a similar fate.

2) Within 120 to 150 days from now the commercial real estate market nationally begins to collapse as stores, malls, and shopping strips, and industrial plant have enough closures (store and plant) and loss of rental revenue to make them unable to pay their mortgages. They will start going into foreclosure unable to pay their mortgages in a significant way at that time creating a second wave of economic disaster starting three to four months from now.

3) Unless oil stays above $70 a barrel Russian and Mexican economics will begin to unravel as countries ("socio-economic collapse) economies require that much from oil to have an adequate revenue stream to feed their people and economies. AND, the only other big revenue stream for Mexico is illegal drugs sold in the US...so their economy will intensify their focus on selling drugs in America as a result in order to survive if oil doesn't stay above $70...he said $90 would be better for them.

4) The US economy (according to Bronner) is today like a patient in the emergency room in the process of having a heart attack. He said people tend to think of it as being in the hospital for cancer or chronic disease. Without the huge Bush stimulus, and then the huge Obama stimulus, the economy would have already flat lined...(i.e. we'd be experiencing a Great Depression style economic collapse heading toward 25% unemployment or so as the tumble would have continued and intensified at an increasing rate, with the stock market hitting around 2,000) Bronner said the depth of the crisis was greater than ANYONE realized and agrees today, after learning the extent of the crisis, that the federal government simply had to start "shoveling" money at it to prevent a true and complete collapse of our economy. He said he, at first, was mad at this shoveling of money until he learned the truth about the amount of money necessary to prevent a total collapse which he believes would have happened.

5) Inflation will not arrive for 3 to 5 years as the economy is in a deflationary stage due to the economic plummet...and will not experience inflation until people start "buying things" again, and that's going to take while! He also believes 3 to 5 years is probably the term until true economic recovery establishes in the US and world economy.

6) China must start selling their products to people in their own country and paying their workers enough to buy them. This would increase their products prices, reducing their exports (and "besides they will lose interest in having more US dollars anyway") and enabling other countries (US) to compete with them.)

7) The greatest threat to the US economy is one of around 9 world events that could heap misery on top of misfortune at exactly the wrong time. A nuclear incident with N Korea, a plague, Israel attacking Iran (oil shock), or such could still throw the US economy into a Great Depression style situation. He said the greatest risk of this is anytime from now until the world economy gets somewhat back on it's feet...in 3 to 5 years.

Not all his thoughts may play out, but it's another voice to listen to. Although his ideas are quite pessimistic, they're more realistic than 90% of the garbage in today's media.

Monday, July 6, 2009

Monday Random's

Back from a great 4th of July weekend. It doesn't get any better than spending time with family and friends while sharing a bunch of laughs in great weather. Add to that, we saw another Tiger victory (#68), possibly the best tennis match I've ever watched, in the final at Wimbeldon with Federer and Roddick, the Celtics signed a solid bench player in Rasheed Wallace and veteran Red Sox pitcher, Tim Wakefield, made his first all-star team. It's simply a great time to be a sports fan....actually it always is, but it's still great to be able to watch the careers of Woods and Federer blossom in front of our eyes.

Couple random thoughts from the capital markets/economy...

-California is now issuing IOU's to various state vendors, as lawmakers ineptly try to piece together a budget which will not send the Golden State further into bankruptcy. All I can picture is Harry and Lloyd from Dumb and Dumber, with a briefcase full of IOU's because they spent all the real cash. It sounds surreal and is quite sickening. California would be the 8th largest economy, as measured by GDP, in the world if it were an autonomous state. It now faces a $24.3 billion deficit for the new fiscal year which began July 1. I'd say that it's a pretty good leading indicator for what's to come for the rest of the states and the country as a whole. Not pretty. The most asinine news coming from this state is that the Democrats want to raise taxes to fund the budget deficit. You serious? Rather than cut wasteful government spending, let's just add more to the people's tab. Societal acrimony anyone?

-Sweden set bank deposit rates at -0.25%. That's right, -0.25%. How the hell do you entice people to save when they are getting charged to keep their money in a bank? Have the central bankers gone mad? Let's pray that this move is extremely unsuccessful so that our own central bank brainchild, Ben Bernanke, doesn't try this move at home. These Keynesian economists are really pissing me off with their radical thought process. How anyone can buy into this, I don't know, but clearly things are going to get a lot worse, globally, before things get better.

-In an interview with ABC, Vice President, Joe Biden, said,"Our administration misread how bad the economy that we inherited truly was." After that he goes on to say that talks of a second stimulus package are being discussed. Only 10% of the $787 has been spent so far. This has clearly done nothing other than put future generations deeper in debt and allocate money for pet projects for the good folks that voted for Obama. Another surreal and sickening piece of news.

-As if you can't tell, I'm not too happy/confident with the way things are going, stock market aside. It's as if many of our "leaders" are still living in some type of fantasy land. All we've been doing for years is kicking the can further down the road so that someone else has to deal with the problems. How about we man up for once and show some actual leadership. By now, people know that we are not in ordinary times. I'm not trying to turn this into a political statement, because honestly, I'm not a Republican nor am I a Democrat; I am a capitalist. I will affiliate myself with whichever party has the most viable economic policy. I believe that if a country has a healthy economy, wealth is created, the standard of living rises and social moods rise in kind. This is the way a country should be ran. Capitalism gives every man a chance to create as much wealth as he is willing to work for. It doesn't seem as if our "leaders" agree with my thoughts, but I truly believe, down deep, the majority of the American people do. When will a voice of reason emerge? Where is John Galt when you need him?

Tuesday, June 30, 2009

First half review

2009 is halfway over. Say it out loud and it's a bit more striking. This year has absolutely flown by. Chaotic capital markets have made things so frantic that time seems to literally slip through our fingers. Take a minute to think of all the major events which have occurred in the past six months. Many of these events will be written in our grandchildren's history books. Some for the better, some for the worse, as we traverse through these trying times.

Some year to date returns from U.S. Markets

YTD

SP 500 +1.78%

DJIA -3.75%

Nasdaq +16.36

Sectors

Basic Materials +8.92%

Capital Goods -14.74%

Conglomerates -15.19%

Consumer Cyclical +6.67%

Consumer Non-cyclical -13.78%

Energy +5.41%

Financials -0.63%

Healthcare -11.53%

Services -4.90%

Technology +12.93%

Transportation -7.83%

Utilities -3.83%

DXY (US Dollar) -1.76%

3-month Treasury +100%

5-yr Treasury +69.5%

10-yr Treasury +60%

30-yr Treasury +62%

VIX (Volatility Index) -33.42%

Gold +6%

These numbers speak for themselves. Most eye striking is the YTD return on the Nasdaq. Clearly investors have indicated technology as the sector which will lead us out of this crisis. It's rather ironic because the other positive performers are our basic necessities: Basic materials and energy. Consumer non-cyclicals are in the red YTD most due to the major run up in commodity prices, thanks in part to China. Consumer cyclicals is a bit of a conundrum, because you'd figure with such a massive slowdown and the ever rising tide of job losses, cyclical products would not have performed well, but it seems as if people are grasping for straws in the dying days of conspicuous consumption.

Since the economy has clearly slowed, the performance in capital goods has reflected that. Companies aren't expanding as much as they were previously and therefore less capital goods are needed. Conglomerates have been catching a beating as well. I've been in the camp that believe conglomerates are a thing of the past. We are moving towards times in which specialty firms will gain market share over the one-stop-shop business models such as Citi, GE and General Motors to name a few. Healthcare, typically a safer sector, has shown weakness since mid-February, when the initial budget was proposed and almost $650 billion was allocated towards healthcare reform aka healthcare nationalization. Transportation, another indicator of the health of the economy, is down nearly 8%. With less economic activity, fewer amount of goods are needed to be transported, whether consumer or capital goods.

The Treasury market has risen in fear of inflation, possible U.S. debt default, or weakness in the dollar. Either way, investors are demanding a higher return in their "riskless" fixed income investments. After touching the mark of the beast, 666 in the SP and then catapulting nearly 44% higher in under three months, is it safe to say we should expect a bumpy ride in the second half of 2009? I believe so. With quarter end finishing with a whimper rather than a bang, watch for the next couple of days to be pretty volatile, despite the light volumes. I will stick with my theory and say that we will see the SP back in the mid 700 range by the fall. We could obviously go lower than that, but on the flip side, we could also see a thrust above 1,000 before we see some serious downside pressure persist.

Earnings seasons should be a doozy, with the second quarter (one time) profitability...ehhh I mean newly sustainable and profitable, banking sector leading the charge. Are these one time gains baked into the cake already? It's hard to tell, but with the recent issuance of the new debt......stock, seemingly flooding the financial sector landscape, I find it hard to imagine future earnings will be as robust as they currently appear to be. Without a properly functioning banking system, no economic recovery is sustainable. With continued job losses and further housing price declines, serious pressure will be applied to the banks balance sheets. How will the markets react once the stimulus euphoria/green shoots (weeds) have worn off? Only time will tell, but it will sure be an exciting and albeit scary ride. In the end, 2009 will, in my humble opinion, look like a W; based on YTD market performance, upcoming earnings season, further deterioration of the housing sector (prime & alt-a), continued negative trending social mood and most importantly, investor psychology.

As always, good luck, and remember, the popular opinion is rarely the profitable one!

Thursday, June 25, 2009

A little knowledge can be a dangerous thing

This is an excerpt from one of the professors over at Minyanville, Jeffrey Cooper. This dude is very witty and one of the great trader's, who flies under the radar, in today's capital markets. This one of the deepest and most truthful pieces I've read. A similar concept is conveyed in The Alchemy of Finance by George Soros. Enjoy!

Is there any other way to trade other than technicals? Sure, buy and hope....hope that the information you're gleaning over and the numbers you're crunching are meaningful and the data points are real.

Don't confuse information with enlightenment any more than you would your position with your best interests. Don't confuse speculation with fundamentals because in the end, we're all speculating as to an outcome; some have a sharper edge than others. Some have a better hand than others, as in the marked deck that recent history has revealed and the ancient history of the stock market.

After all, following the great short campaign of 1929, is it any coincidence that the fox was put in charge of the hen house with Joe Kennedy becoming head of the SEC?

Quoting George Soros, "economic history is a never ending series of episodes based on falsehoods and lies, not truths. It represents the path to big money. The object is to recognize the trend, whose premise is false, ride that trend, and step off before it's discredited."

The Street and the public love a good story. P.T. Barnum said there's a sucker born every minute. There's two born every minute in financial markets.

Don't confuse long lasting trends with a truthful premise. Time doesn't make a falsehood any less of a lie.

Jay Leno once asked a young girl on his show what two animals signified the stock market. She replied, "the snake and the mouse".

Those that "control" the game have always been the snake and investors have been the mouse.

Unless you have large amounts of capital (translation - staying power) such as Paulson, who bet against the CDS market in the beginning of 2005 or Julian Roberston, who bet against the "new paradigm" in 1999, you must use technicals to weather the storm, no matter what you think you may "know".

Is there any other way to trade other than technicals? Sure, buy and hope....hope that the information you're gleaning over and the numbers you're crunching are meaningful and the data points are real.

Don't confuse information with enlightenment any more than you would your position with your best interests. Don't confuse speculation with fundamentals because in the end, we're all speculating as to an outcome; some have a sharper edge than others. Some have a better hand than others, as in the marked deck that recent history has revealed and the ancient history of the stock market.

After all, following the great short campaign of 1929, is it any coincidence that the fox was put in charge of the hen house with Joe Kennedy becoming head of the SEC?

Quoting George Soros, "economic history is a never ending series of episodes based on falsehoods and lies, not truths. It represents the path to big money. The object is to recognize the trend, whose premise is false, ride that trend, and step off before it's discredited."

The Street and the public love a good story. P.T. Barnum said there's a sucker born every minute. There's two born every minute in financial markets.

Don't confuse long lasting trends with a truthful premise. Time doesn't make a falsehood any less of a lie.

Jay Leno once asked a young girl on his show what two animals signified the stock market. She replied, "the snake and the mouse".

Those that "control" the game have always been the snake and investors have been the mouse.

Unless you have large amounts of capital (translation - staying power) such as Paulson, who bet against the CDS market in the beginning of 2005 or Julian Roberston, who bet against the "new paradigm" in 1999, you must use technicals to weather the storm, no matter what you think you may "know".

Wednesday, June 24, 2009

The D word

Sorry, for the delay, but I had issues with my internet connection and I was away for a few days attending the U.S. Open in New York. The weather caused the tournament to be a bit hectic, but nonetheless it ended with a bang. Not going to lie...I was rooting for Mickelson. With everything he has gone through in the past weeks, and will have to face in the near future, it's hard not to root for Lefty. It was great to see Duval, who overcame vertigo, make a run for the championship as well. Congratulations to Lucas Glover for playing well on Monday to win the Open. I would have liked to see the Open played in better conditions but it is what it is and the tournament was a success. The atmosphere was great. It was my first major and surly won't be my last. I like the fact the PGA gives public courses the opportunity to show they are worthy of hosting a major.

While in New York, I attended a Mets game as well. If you weren't aware, they recently built a new stadium, Citi Field. The amenities were great and the staff was friendly. The lines for beer were quick and they even served corona...a major plus. A far cry from Fenway, but still great to see a new stadium. The overall atmosphere doesn't compare to that of Boston, but what else can you expect after watching most of my professional sports games in the most diehard sports city in the country.

I'd like to talk about one of the major debates going on in the economy today. The inflation vs. deflation issue. For the sake of keeping the blog quick and concise, I'll talk about the side which I strongly believe will play out.

Most of the people you hear talking will this side with inflation. In fact, I'd go as far as to say about 80% of pundits believe inflation is the major concern. Sure, inflation will no doubt be an issue down the road, but it could be years away before we see a whiff of it....at least the runaway inflation scenario which everyone seems to be so concerned with. Being a contrarian, I like to go against popular opinion and side with the deflationists. Any practical economist should be able to see deflation looking straight into the eyes of the U.S. economy.

Listen, the Fed would not have throw trillion upon trillions of dollar at this mess, to re-inflate our economy if they didn't see the deflation locomotive heading right at them. Even after they've thrown trillions of dollars at this, the phantom of deflation is still winning the battle.

First off, the U.S. is a credit (debt) based economy. Simply put, this means there is far more debt in our economy than cold hard cash, thanks to the fractional reserve lending system. As I've discussed before, debt (credit) was cheap (low interest rates) after the burst of the tech bubble. This cheap debt inflated nearly every asset class. Now that that debt can't be repaid, asset prices need to readjust back to reality. This is called debt destruction. Debt destruction is deflationary because money is destroyed which causes general decline in prices. This can easily cripple an economy and was the monetary phenomenon that took place during the Great Depression, which is why the Fed is trying to avoid it all costs....literally.

To avoid deflation the Fed has given trillions of dollars to the banks to shore up their balance sheets. If the banks don't have money to lend, businesses cannot operate, consumers cannot borrow and the economy will slow. Prices will need to drop in order for people to be able to afford goods and services. Econ 101 - supply and demand: Banks have the supply, but their isn't the same demand for the debt as there use to be. The household debt to income ratio is about 130%. This basically means that for every $100 earned, the average household has $130 in debt payments. This could be in the form of credit cards, mortgages, auto loans, student loans, etc. The consumer is beginning to deleverage (reduce debt) and is no longer willing to borrow money, which it cannot repay. Add to the fact that lending standards have tightened and you can see the strain that has been put on our credit based economy.

Now, you need to also factor in the massive job losses the U.S. The more jobs lost, the less money in the system. This slows the down the velocity of money, which is deflationary. Debt payments cannot be met, which will hurt the banks holding securitized assets even more. We are seeing record high credit card write downs now. People literally do not have the money to pay their bills. It's a scary situation. The banks have these massive reserves they are sitting on. I believe they are sitting on these because they see the economy getting worse and will need the money to keep there balance sheets in somewhat decent shape. Go back and look at the mortgage reset graph I posted last month and you'll see the other crisis which we will soon be facing. Money will be needed to offset these massive losses. This is, once again, deflationary.

The consumer makes up about 70% of GDP. Now that they aren't spending, businesses are slowing down. The government is trying to step in to replace where the consumer has fallen off, but they don't have the funds nor the brains to allocate the capital properly.

From a business standpoint, the PPI (producer price index) recently dropped to its lowest level since 1949, capacity utilization has fallen off the cliff, and industrial production has slowed down massively...all major signs of deflation.

So while most economists continue to be infatuated with inflation, I expect more deflation to be coming our way. I'm not sure if they just want to ignore the signals or just look at all the money the Fed has printed and associate inflation with that. There are many valid arguments made for both sides, but from where I sit, deflation is the major concern and will continue to be for the foreseeable future.

Without going into too much detail, this provides the premise from which I base my deflation bias upon. If you have a different point of view, feel free to share it and we can discuss the matter.

Update

Sorry, I haven't posted in a week. I was away for a few days and I've been having issues with my internet. Will have a post later today. Stay tuned.

Tuesday, June 16, 2009

What is the dollar?

This is an article from 2006 about the dollar. It is a quick read about what the dollar actually is and how it affects global markets and our daily lives. It is very simplistic, but understanding how the dollar fits into markets/economics is essential. Enjoy!

http://www.minyanville.com/articles/Dollar-Five+Things-Special+Edition/index/a/13266/from/ameritrade

http://www.minyanville.com/articles/Dollar-Five+Things-Special+Edition/index/a/13266/from/ameritrade

Monday, June 15, 2009

Monday sell off

Today, we saw the first big sell off in month. Equities have been trading in the 920-950 (S&P) range since May 29. Multiple attempts to break through 950 have been shot down and today, the market briefly broke through 920, only to recapture the support level moments later. This is like a heavyweight fight with the bulls and bears battling to gain traction. Neither have been victorious thus far and it looks like the fight will come down to the wire. With mixed economic data the past couple of weeks, neither side has seen the catalyst that will send the market one way or the other.

With options expiration this Friday, and quarter end only ten trading days away, volatility will be sure to pick up starting tomorrow with turnaround Tuesday. Treasury rates have seen a steady decline since last Thursday's 30-yr auction. The dollar has been seen some strength the past few sessions which has helped ease rates. Last week's auction in the 30-yr saw 49% of indirect bidders. This shows that FCB's (foreign central banks) may not be as reluctant as they pose to be, when it comes to buying long dated Treasuries.

This brings to life a couple of questions. It has been known that China has been stockpiling commodities. Now that those commodities have risen in price, did China use some of their dollars to purchase Treasuries? There have been reports that China has under-utilized many of the commodities they purchased. Did they buy the commodities because they actually need them or because the value presented was too good to pass up? Has the strength of the Chinese economy been a red herring for an economic green shoot? Just a couple ideas to keep chew on.

While each day in the capital markets is exciting, the past three weeks or so, has seen markets trading in a pretty tight range. This has lulled some people to sleep, but the market has a way of making violent moves when people become complacent. While all may seem calm on the surface, I think a pretty big move about 950 or below 920 is in store for the next two trading weeks. This is a good time to rebalance your portfolio and make sure you're hedged for movements in either direction. Good luck!

Wednesday, June 10, 2009

The Federal Reserve...coming under fire

The heat is getting turned up on the Federal Reserve. Congressman Ron Paul initiated a Bill, HR 1207, to audit the Fed. It has been gaining momentum and has 207 co-sponsors, but 218 is needed in order for it to move to the Senate. If this Bill somehow gets passed, the Fed will be exposed. One can only wonder what the consequences of a failed central bank would be like. I'm not saying this is going to happen, but questions are being raised and investors need to be aware of it. This is a video I posted a month ago today; dealing with the Inspector General.

There is much debate over the Federal Reserve's activity in the Vegas like marriage of BOA and Merrill Lynch this past December. Then Secretary, Hank Paulson, and Ben Bernanke, are said to have strong armed BOA CEO Ken Lewis, into the deal. After BOA discovered how much junk was on the balance sheets at Merrill, they didn't want in. Now, the House Oversight Committee has subpoenaed the Fed. I just read an article saying that BOA has e-mail evidence.

"WASHINGTON -- Internal Bank of America documents and e-mails among federal banking regulators show that federal officials leaned on the bank to seal the acquisition of Merrill Lynch in December or else face a management upheaval if the company wanted government assistance." - Miami Herald

Lewis was put in a jam and could have lost his job if he didn't seal the $50 billion deal. I'm all set with that choice. Anyway, the cracks are starting to be revealed in the Fed's model, both fundamentally and socially. This may have some pretty serious consequences. If they were to be shut down, then the economy would flourish, but that's a whole other subject. All in all, it's just another thing money managers need to keep in mind for their portfolios.

Finally, I found this video on another blog I read and found it interesting. Most of the stuff on CNBC during the day is garbage, but James Grant is a brilliant economist. He talks about the Fed throughout his interview, but it's very interesting to hear his thoughts on inflation and why he believes the velocity of money (how fast money moves around the economy) has little to do with inflation; it's the actual amount of money in the economy, that's going to cause inflation. It's another lens to look through, which can only help.

The market rallied pretty good from about 2:30 on today, but finished down. Tomorrow will be volatile as well with the 30-yr auction. Will Benny B start ramping up the presses again? Only time will tell but at this moment futures are up a bit now, Asian stocks are in the red, the dollar is down and oil is up to $71.89. It'll be interesting so get ready.

10-Yr Auction & a couple randoms

There's certainly a lot of news to talk about today, but I just wanted to post the results of today's important bond auction.

Estimates: Yield - 3.94% Bid-to-cover - 2.36 Indirect bidderss - 26%

Actual: Yield (high yield) - 3.99% Bid-to-cover 2.62 Indirect bidders - 34.2%

While the bid-to-cover and indirect bidders were stronger than expected, we saw a 5 basis point TAIL on the 10-yr notes, which is not a good sign.

With all the controversey surrounding the Fed, (which I'll talk about later) will Bernanke fire up the printing presses?

Yields on the 30-yr, which has is an auction for $11 billion tomorrow, are up over 3% today.

The market gapped up today, with futures touching the almighty 951 resistance level. After the opening bell we quickly saw the market recede. It's going to take more than strong futures and wobbily optimism to push the market through major resistance.

The market didn't like what it saw from the auction, as it is down almost 1.5%, with about two hours left in the trading day. Oil busted through resistance at the $70 level, in the face of the dollar index up 0.75%. REIT's are taking one on the chin today down 3.75%, with it's ETF counterpart, SRS, up over 7.5%.

Look for continued volatility through tomorrow until the 30-yr auction results are released. It's a good idea to stay hedged at this point (complete understatement) with equities being whipped around so much. I'll a blog on the pressure building at the Fed a bit later. Good luck!

Estimates: Yield - 3.94% Bid-to-cover - 2.36 Indirect bidderss - 26%

Actual: Yield (high yield) - 3.99% Bid-to-cover 2.62 Indirect bidders - 34.2%

While the bid-to-cover and indirect bidders were stronger than expected, we saw a 5 basis point TAIL on the 10-yr notes, which is not a good sign.

With all the controversey surrounding the Fed, (which I'll talk about later) will Bernanke fire up the printing presses?

Yields on the 30-yr, which has is an auction for $11 billion tomorrow, are up over 3% today.

The market gapped up today, with futures touching the almighty 951 resistance level. After the opening bell we quickly saw the market recede. It's going to take more than strong futures and wobbily optimism to push the market through major resistance.